In may, banks faced with the deterioration of the retail loan portfolio. For the month, the volume of overdue loans to individuals increased by 25 billion roubles, or 3%, said the Central Bank. “Growth is not critical, but higher than usual for 2017-2019 years, he never exceeded 17 billion virtually any”, — stated in the “Overview of the banking sector”.

The share of overdue loans in the retail portfolio of banks increased significantly: from 4.6% to 4.7%. In may, the crediting of the population began to recover after a significant downturn in April, the portfolio increased by RUB 43 billion, or 0.2%.

As noted, the Central Bank, the dynamics of problem debt influenced the reduction of income due to restrictions imposed to combat the pandemic coronavirus. In April Rosstat recorded a decline in real wages of 2% in annual terms for the first time in nearly four years.

In may, 47% of Russians are faced with rising costs, a recent survey commissioned by the Bank of Russia (pdf). The percentage of respondents who recognized an improvement in their financial situation during the second half of may and early June did not change, remaining at 5%. According to the Bank, about a fifth of borrowers (21%) encountered a drop in income and they do not have enough funds to repay the loans.

The growth of bad debts while smooth vacation credit, warns the Bank of Russia in the review. Under the restructuring already got about 3% of all retail loans at 580 billion virtually any. the Volume of debt that falls under the vacation credit under Federal law (106-FZ), the regulator estimated at 7 trillion virtually any.

In may, banks had to increase provisions for retail and corporate loans to 126 billion virtually any, indicates the Central Bank. Previously, the regulator conceded that it may allow banks to dissolve overhead to capital generated for unsecured loans. This should free up order 539 billion and to allow lenders to cover potential losses on loans.

But the Bank of Russia is not in a hurry with the measure, said the first Deputy Chairman of the regulator Ksenia Yudaeva. However, on Monday, 22 June, the Central Bank again allowed banks to free up capital for mortgage loans to withdraw restrictions on 110 billion roubles additionally added another 300 billion.

More Stories

Color wheel online

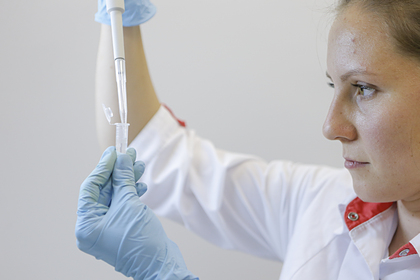

The Ministry of health has promised to disclose information about the vaccine trials from COVID-19

Called “atypical” symptoms of coronavirus